A key way to make your marketing effective is trying to understand the “value” of your individual customer. Termed ‘Customer Lifetime Value’ (CLV), there are many models that measure this metric,One of the model is RFM model.

Developing a comprehensive and effective model of customer profitability requires an answer to the question – who are my most profitable customers? Is the RFM Model and RFM analysis relevant even today?

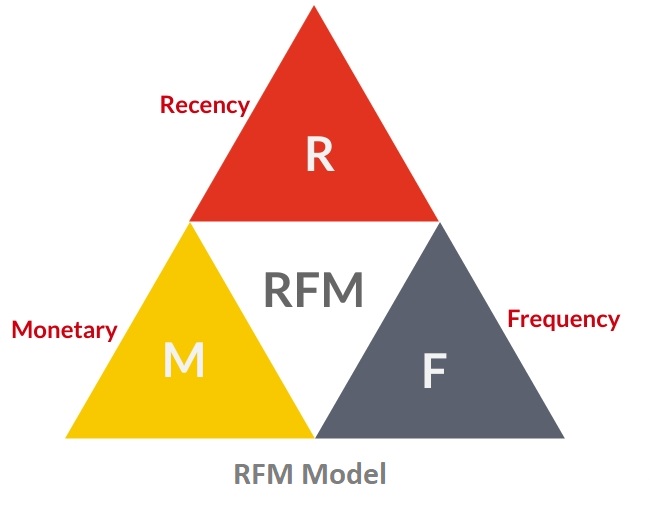

One of the models that have been in use for years to segment your customers to calculate their CLV is the Recency, Frequency, Monetary (RFM) Analysis statistical model.

Using it for customer segmentation gives a picture of the past, showing what your customers were like, and is a good indicator of what your next goals should be.

Table of Contents

- How RFM Analysis Can Help You Maximize Customer Lifetime Value

- How RFM Analysis Works (in a nutshell)

- What Is A Good RFM Score

- How Can I Improve My RFM Model

- What you must watch out for in RFM Model

- Customer Segmentation Using RFM Analysis

- New clients: where’s the frequency score?

- Evolution of RFM Model

- How RFM Analysis Helps Improve Business Understanding

What is RFM Analysis?

RFM analysis is based on the Pareto principle, AKA the 80/20 rule. The rule states that ‘80% of the business comes from 20% of the clients’.

Therefore, understanding who that 20% of your clients are is important, right?

RFM helps compartmentalize customers into clusters to identify those who are more likely to respond to promotions and also to upsell or cross-sell.

Interested in knowing how the RFM Analysis will work for your business? Click Here and our experts will get in touch with you.

How RFM Analysis can Help You Maximize Customer Lifetime Value

If you’re looking to improve your business’s bottom line, one of the best places to start is by increasing customer lifetime value.

And one of the most effective ways to do that is through RFM analysis. RFM stands for “recency, frequency, and monetary. ”

In other words, it’s a way of measuring how recently a customer has purchased from you, how often they purchase, and how much they spend.

By understanding these three factors, you can more effectively target your marketing efforts. And you can increase customer lifetime value.

RFM analysis is easy to do and its results are invaluable.

There are a few things you need to do before you begin analyzing your customers:

- Decide which customers to analyze.

- Decide what your “recency” (latest) will be.

- Decide what your “frequency” (period of buying) will be.

- Decide what your “monetary” (money as a value) will be.

- Analyze your customers.

- Make some decisions based on your analysis.

Maximize your customer lifetime value with RFM modeling

How RFM Analysis Works (in a nutshell):

Recency: Refers to the last time someone purchased from your business. What it means is a client who has bought recently is more likely to repeat as compared to one who hasn’t purchased for a long time.

Frequency: Refers to the number of times a client has purchased in a given period. The logic here is a customer who buys often will probably return in comparison to one who rarely purchases.

Monetary Value: Refers to the amount a client has spent in the same period. Obviously, one who has bought more is expected to return more often than one who has not.

What is A Good RFM Score?

The RFM score shows the value you assign to every variable applied in RFM analysis process, in short, the values of recency, frequency, and monetary.

The RFM score is a statistical score that assists you to identify all kinds of consumers, from the greatest to the worst.

A good RFM score is one that indicates how likely a customer is to make a purchase, based on his/her past behavior.

A high RFM score means that you have a higher likelihood of keeping the customer, and that they will be loyal and return in the future.

A low RFM score means that you have lower chances of keeping the customer.

The RFM score formula is:

[Score of Recency x Weight of Recency] + [Score of Frequency x Weight of Frequency] + [Score of Monetary x Weight of Monetary]

In order to compute RFM scores, you first need the values of attributes for each customer. Attributes may include:

- Last purchase date

- Number of transactions within the last one year

- Total sales attributed to the customer…. and so on.

Once this is done you will have to assign a number for each RFM attribute. It can be anywhere between 1 and 5.

RFM analysis ranks each customer for each factor on a 1 to 5 scale (5 is highest). If you decide to code each RFM attribute into 5 categories, the highest score will be 555 and the lowest will be 111.

The 3 scores together are the RFM ‘cell’ for each customer, ranking their historical propensity to buy, with a ‘555’ customer ranking at the top and one with 111 at the lowest rung.

In this way, using RFM to segment customers, one can analyze each group to understand which one has the highest CLV.

But here’s the thing: Not all customers are created equal.

RFM Model (RFM Analysis) may work for small and medium scale enterprises because of Its’:

- Inherent simplicity

- Effectiveness in direct marketing campaigns

- Affordability

- DIY nature

But if you are a large company having the wherewithal at your command, using RFM along with predictive analytics models is highly recommended.

Predictive analytics does a far better job at forecasting sales and offers a better RoI segmentation based on RFM. But, then again, this is a costly method and not everyone can afford it.

Role of RFM Model in Customer Retention

The RFM model is a well-known customer retention tool that businesses use to segment and target their customers.

The RFM model is a predictive tool that forecasts how likely the customer is to purchase in the future.

It is also a customer retention tool, used to segment and target your customers.

With its help, you can distinguish between customers that would not be interested in your product and those who will definitely be interested in your product.

How can I Improve My RFM Model?

While there is no definitive answer to this question as it depends on the specific circumstances of your model and business, there are some obvious ways how you might improve your RFM model.

These include: ensuring that your data is of high quality, ensuring it accurately reflects customer behavior; using a robust method for calculating recency, frequency, and monetary value; and testing and refining your model on a regular basis.

What You Must Watch Out for in RFM Model

You must be aware of the following:

There’s always the impulse to target customers with the highest rankings but that would be wrong.

Here’s why: It’s probable that customers who brought in the highest revenue may be casual. This information gives a clear signal that you should focus more on this group.

There’s also the instinct to ignore customers with low scores, and that too would be erroneous.

To avoid over-solicitation of high-ranking customers for it could lead to resentment making them flee from your business.

But the most important issue with the RFM model is the presumption that your best buyers will continue to be the best responders in your marketing campaigns.

Yes, historical behavior does provide a roadmap for the future but it’s not truly predictive.

As Anusha Acharya writes, this assumption ignores the fact that customer behavior might change over time or might have already changed.

RFM Models: Use Cases/Examples

RFM models are commonly used in marketing to identify the best customers in order to target them with specific campaigns.

A successful RFM campaign targets products to consumers who have indicated an interest in those products (that is, customers who have purchased those products or indicated they would be).

Note that the model also has filters to only target customers who are new; meaning that the marketing campaigns must be fairly targeted.

In other words, campaigns that target new customers must be relevant to them.

RFM models can also be used for forecasting and planning purposes.

Take for example a company that manufactures mobile phones: one could use the RFM model to forecast what types of new models to introduce in the future, based on their “revenue lift”.

Customer Segmentation Using RFM Analysis

Customer segmentation using RFM analysis is a process of dividing customers into groups based on how recently they made a purchase, how often they make a purchase, and how much they spend.

This segmentation can be used to target different marketing campaigns to different groups of customers.

For example, customers who are identified as high-value customers who make frequent purchases may be targeted with loyalty programs or special discounts.

Demographics analysis: Customer segmentation based on demographics, such as age, gender, family status, and household income, is a very useful tool for business.

The demographic information can be used to segment customers into groups of people who share the same demographic characteristics.

By collecting demographic information on a customer and their behavior, you can target the customer with more effective advertisements.

Customer segmentation based on demographics is the process of dividing customers into groups based on their demographic characteristics.

Maximize your customer lifetime value with RFM modeling

New Clients: Where’s The Frequency Score?

Another issue for the RFM analysis is new clients. New clients tend to buy cheap products just to test the company’s services, which skews the model.

But the other, more concerning problem is – how do you score new customers?

New customers have only bought once, so they can’t have a “good” frequency count, even though they may do well in the “Recency” and “Monetary” scores.

So how does one account for them? Remember, the F in RFM stands for frequency, so clearly, that value cannot be derived for new clients.

To get around this hurdle, the data science team at Express Analytics has built a layer on the RFM Analysis to spot the potential among the new customers which helps in identifying those customers who are most likely to turn into high profile ones down the line.

Evolution of RFM Model

Since its inception over forty years ago, the RFM Analysis has evolved many times

Each iteration and variation involves mixing in new components to improve the model’s ability to predict.

Some examples of RFM analysis: Ya-Yueh Shih and Chung-Yuan Liu (2003) proposed two-hybrid methods that exploited a weighted RFM-based method (WRFM-based method) or the preference-based Collaborative Filtering (CF) method to improve the quality of product recommendations.

Their findings indicated that the proposed hybrid methods were superior to the other methods.

Rust and Verhoef (2005) provided a fully personalized model for optimizing multiple marketing interventions in the intermediate term.

This was done by conducting a longitudinal validation test to compare the performance of the model with segmentation models used in predicting the intermediate-term and customer-specific gross profit change.

This battery of models tested included demographic model, RFM model, and finite mixture models.

Their results show that the proposed model outperformed traditional models in predicting effectiveness in the intermediate-term (CRM).

How RFM Analysis helps Improve Business Understanding

RFM analysis is a marketing technique that uses customer purchase data to determine the value of each customer.

This information is then used to target customers with specific marketing messages.

RFM analysis is a powerful marketing tool that can help businesses improve their understanding of their customers.

By analyzing customer purchase data, businesses can identify their most valuable customers and target them with specific marketing messages.

The purpose is to use customer purchase data to gain insights into customers’ motivations and preferences.

By learning what customers buy, businesses can understand better the types of products and services they are interested in.

This can then be used to help businesses develop and implement more effective marketing campaigns.

Without a doubt, the RFM Analysis is a valuable marketing analysis and segmentation tool for many B2B businesses.

How well do you know your customers? Only when you know them inside out can you deliver the best customer experience. Our customer data platform Oyster helps you keep the Recency, Frequency, Monetary Value (RFM) score. With RFM analysis, your business can assess a customer’s propensity to buy. Want to more about how Oyster can keep the score for you? Click here.

References:

The ABCs of RFM – and How it Can Help You Retain Your Customers

No comments yet.