12 Proactive Strategies to Reduce Customer Churn Rate

How to reduce your customer churn rate? Are you struggling to retain customers? Is your business experiencing high customer churn rates? Do you think you’re doing everything possible to retain your customers? The question you must ask yourself is – are you really doing all you can do to stop this turnover?

The concept of customer churn is a simple one: how many customers did you have at the beginning of the year and how many do you have now? If more customers have been lost than won, you have a problem.

This post will try and help you with that question, and also help you understand the various tactics that can be deployed to lower your customer churn rate.

Table of Contents

- Definition Of Customer Churn

- Understanding The Churn Rate

- Factors Influencing Customer Retention

- 12 Proven Strategies to Reduce Customer Churn Rate

Customer Churn Definition

The number of customers who leave your business in a given period is called churn. Churn can be analyzed at the customer, account, product, or service level. Customer churn rate, not the same as revenue churn rate, is the frequency at which individual customers leave a business in a specific time period.

It can also be looked at by product/service, or at the account level. According to the Chicago Booth Business School, there are four main reasons for churn: no loyalty, no reason to stay, poor customer service, and technology risk.

Your customer churn rate can be calculated by dividing the total number of customers at the beginning of the year by the total number at the end.

This way, if you know that you had 25 customers at the beginning of the year, and after that time 15 left, your churn rate would be 15 / 25 = 0.42.

Dividing this number by your total number of customers for the year could show you how many new customers have left in comparison to those who remain with your company.

Keep in mind that the 0.42 number is an approximation, and shouldn’t be used for precise analysis, but rather to provide an idea of your average churn rate.

For example, if your customer churn rate is 0.42 and you have 4 active customers in a month, the average number of active customers in a month is 0.42 divided by 4 = 0.21.

Your monthly churn rate would then be 21% – or 1 out of every 4 active customers leaves within a month.

In general, companies that are growing their business at 10%+ annual rates usually have very low (less than 5%) average customer churn rates.

Whatever the breakdown, it’s important to quantify your churn so that you can understand and manage it.

Churn should be measured at all levels of an organization – this helps determine if something is going on which could be costing the business money and time, and helps identify factors that may be contributing to increased or decreased churn.

Prospect New Customers with the Lowest Churn and Highest LTV

At the same time, remember, not all churn is bad. Churn can be both, good and bad. Good churn is when customers are leaving because they are moving to a different product or business, altogether.

It could also be a case of customer misfit. Not every new customer is an automatic fit for your product or service. Bad churn, on the other hand, is when customers are leaving because of poor service or a poor product, perhaps losing money on the deal.

If you have a positive churn rate, it’s a great thing. When the growth rate exceeds the churn rate, the company has grown, and so it is positive churn. A company experiences a loss in customer base when its churn rate is higher than its growth rate.

You can estimate how many customers you will have in the future with some simple math, provided you have a good retention rate. This is expressed as an “average customer lifetime value” or ACLV.

So you take the amount of money that a customer spends with you and divide it by their churn rate. You then multiply that number by the number of customers you have.

Understanding Your Customer Churn Rate

If you’re struggling to retain customers, it’s critical that you understand the reasons why.

Every business experiences churn. Obviously, you want to lower your customer churn rate and work toward keeping more of your customers, because higher retention means higher revenue and profitability.

Achieving a lower customer churn rate means understanding what is causing your current rate of turnover, and how you can eliminate the causes. When you’re trying to reduce your churn rate, there are three important questions that need to be answered:

- Why do customers leave?

- What can you do to help prevent leaving?

- How will you measure the results of your changes?

Keep in mind that it’s alright if some customers leave, you will want to try and reduce the number of such leaving customers.

Why do customers leave? Your customers may be leaving for different reasons, but in the end, your job is to help prevent their loss.

There are two main reasons that can make a customer move away from your business:

Reason #1 – The customer becomes frustrated because he/she feels their needs are not being met. Whether it’s a problem with your product or service, or a billing issue, customers may become frustrated and leave.

To make matters worse, some customers may feel like they are not getting the respect and service that they deserve.

You can avoid this by keeping track of your customer’s feedback and making sure that you address their concerns promptly. If you think that your customer has left because of a problem, you can reach out to them directly through email or phone.

Reason #2 – Customers are looking for a better deal elsewhere. Maybe the customer tried you out, but they are tired of being tied to you. Maybe your services are not meeting their needs anymore.

Now, this might be because the customer wants to save money, or maybe they believe that they are getting a better deal elsewhere. If your services are good enough, then it shouldn’t be too hard to entice them back.

There are a couple of ways to do this. A common way is to offer them a better deal. Let’s say you charge $300 for your one-month service and the customer’s monthly bill is $500.

Offer to give them your service for $250 for a full year. This is one way of increasing your customer’s lifetime value.

What can you do to help prevent customers from leaving? First, if you are online, your website should be well-designed and easy to navigate. Next, you should educate your customers about the benefits of your product.

Example: Let’s say you are a web hosting service, and you have just upgraded your basic web hosting package from 2GB to 10GB this month.

As a customer, it’s difficult to understand the benefits of this. Therefore, they don’t know that a 10GB package is going to be more beneficial for them.

On the other hand, if you have a website that has a lot of content on it, you’re automatically going to lose some customers because people may think that the content is not important enough for them.

For that matter, if your website UI is not good, you can quickly lose potential customers, too.

How will you measure the results of your changes?

There are many ways but the key to all is to document the changes. You may, for example, create a short survey for your customers who visit your website.

Ask them why they came to your website, whether they wanted to leave, and if they did, what made them leave. This will be one of the most important metrics for your website.

It’ll let you know why your site is not performing well, and it’ll help you to understand what needs to be done to increase conversions. Once changes have been made to the website, monitor traffic flow closely to understand whether traffic is staying longer on your website or not.

Factors Influencing Customer Retention

Factors influencing customer retention are the customer’s experiences with a company, their perception of the value they get from the company, the quality of the service provided by the company, and the ability of the company to meet their needs.

In order to retain customers, a company must first provide a high-quality service that meets the needs of its customers. Customer retention is a difficult task, as many factors will influence a customer’s decision to purchase from a particular company.

One factor that can greatly affect customer retention is the satisfaction level of the customer after the purchase.

The perception of the value that a customer receives from a specific company depends on a multitude of factors including their past experience with that company, how good the service is, and the type of product purchased.

If a customer has a poor service experience, he/she may not trust the company again and may subsequently decide to purchase from a different company.

The length of time that customers stay with a company depends on how long they feel that the company provides good value and satisfying experiences.

12 Proven Strategies to Reduce Customer Churn Rate

A success rate of zero (0) percent customer churn rate is the most desired result in the business sector but is it even possible? With a wide variety of strategies and tactics available, this is ultimately what you’ll aim for when working with retention strategies.

Read below to learn how you can reduce customer churn rates:

The average churn rate can be used to compare the industry performance of an individual company with that of others. In this way, it can help identify industries with above-average customer retention and those with below-average retention.

It also helps identify ways to improve customer retention in these particular industries.

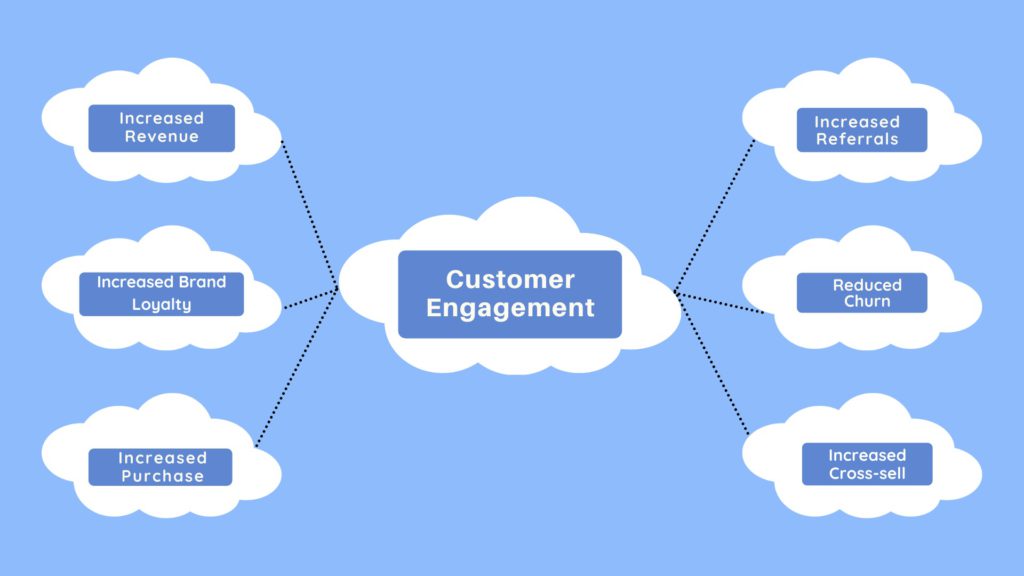

Every business needs customers to be profitable and what better way to do that than keep customers and customers coming back?

When it comes to retention strategies, many rely on cross-selling and up-selling tactics to increase the customer base, which in turn helps grow your revenues.

While it is important that your strategies incorporate this idea of retaining and growing your customer base, it is equally important that you differentiate yourself from the competition in order to be successful.

There are various ways you can do this, but here are some methods to consider when starting your retention strategies:

- Offer your customers to upgrade their accounts

- Create value for your new customers

- Improve customer onboarding

- Innovate

- Keep growing

- Cater to market demand

- Check out the competition

- Improve customer engagement

- Collaborate with other companies

- Increase customer personalization

- Conduct surveys

- Have a dynamic pricing strategy

Offer your customers to upgrade their accounts: This is a great way to increase the lifetime value of your customers. Think about ways you can give more or offer them something they didn’t get before, and watch the value of your customer jump significantly.

For example, we were working with a client who had a rather complicated pricing structure. They had the option of paying the same amount for 12 months or 18 months.

We started offering upgrades to 18-month plans for half price. Suddenly, our monthly recurring revenue jumped more than 10% and the lifetime value of the customer also improved significantly.

This is a great way to increase the lifetime value of your customers.

Create value for your new customers: The whole point of a retention strategy is to bring customers back. If you can create something valuable for your new customers, they will not only return, but they will also be loyal.

One way of offering value to your clients is to create a set of products or services which can provide value to new customers. For example, allow your customers to do their taxes for free in order to have them convert into paying customers.

Improve customer onboarding: Your onboarding process is the single most important stage of your customer’s relationship with your company. It is what creates trust and builds your reputation. Take your time to get it right the first time. In the long run, it’s worth it.

Innovate: Innovation can be a dirty word for many companies. The idea of going against the status quo can be frightening. In reality, innovation is necessary to survive in a world where companies battle for survival every day.

Keep growing: What do you want your business to be in 10 years? Or 20 years? Making large-scale, long-term decisions will require a great deal of risk. But you should always be ready to take the risk to reap the rewards.

Cater to market demand: Ensure your business is catering to market demand. If you’re not, you’ll find it difficult to survive the harsh realities of industry competition.

Check out the competition: Be aware of the competition that is out there. Once you are well aware of your business environment, you can then take measures to ensure that your business is not in danger of being knocked down by others.

Don’t be afraid to check up on your competitors to see what they’re doing in terms of advertising, product line expansion, and more. You might find that it’s time to change up your strategy.

These measures might include:

– Assess your competitors’ strengths and weaknesses. You can do this through market research and surveys, as well as via an analysis of the company’s financial and marketing reports and their current and past performance.

– Identify new trends in the industry. These trends may have a direct impact on your business.

– Work with local or regional trade associations. These associations often host meetings and workshops that focus on a particular industry. Use this resource to learn more about what you can do to increase your brand awareness in the marketplace.

Improve customer engagement: Think about ways you can increase the frequency of customers reaching out to your company.

Create a page on your website that allows users to submit comments, questions, and feedback, as well as register for contests, sweepstakes, and other promotions.

Create a newsletter that reaches your customers monthly and encourages them to take advantage of any offers you’re currently running.

Collaborate with other companies: Many companies work in tandem to increase brand awareness in the marketplace.

Increase customer personalization: The goal is to give each customer the type of treatment that would best fit their personality. This means giving customers exactly what they want, even if it doesn’t match the company’s branding.

For example, if you run a custom pizza place, it would be important to try and tailor the experience as much as possible.

You could provide unique discounts for customers that order at certain times of the day, such as ” Buy an extra pizza for under $20 and get 2% off with this coupon .”

Learn just what to customize. Here are a few examples of specific customizations you can make to help improve conversions:

- Offer an alternative to paying cash

- Provide a discount on the regular price for loyalty

- Customize your coupon text to offer an additional discount

- Special bonus in case of any in-store purchases in the past month

- Special discount only available to new customers

- Extra discounts for business clients

- Optimize checkout experience

- Optimize the offer for mobile. If you have a product that allows you to customize it, this is a good place to start.

Conduct a survey: The best way to figure out how many customers you have is to carry out a survey of your most active customers.

Most businesses do not have the resources to do this sort of analysis on a regular basis, but a smaller business can be efficient at it.

Have a dynamic pricing strategy: Pricing strategies can help boost churn through the use of discounting campaigns. This approach appears to work, but there is still some debate as to whether or not it works for all customers.

In conclusion: High churn rates and the difficulty of retaining customers is a huge challenge for businesses.

One way to combat churn is to identify and address what is causing customers to leave. Another strategy is to work with customers in businesses that are experiencing high churn rates and struggling to retain customers.

This allows them to be proactive and prevent churn from happening. This post also looked at the causes of high churn and the various strategies that can be deployed to address the issue.

An Engine That Drives Customer Intelligence

Oyster is not just a customer data platform (CDP). It is the world’s first customer insights platform (CIP). Why? At its core is your customer. Oyster is a “data unifying software.”

Liked This Article?

Gain more insights, case studies, information on our product, customer data platform