How Predictive Analytics is Reshaping the Insurance Industry

Predictive Analytics is increasingly becoming the “weapon of choice” of insurance firms and industries.

The reasons are many, ease-of-use is one, and the other is because of advances in Artificial Intelligence (AI) and Machine Learning (ML), deployment is easier and faster.

Data analytics overall has started to play a big role in almost all areas of the insurance sector such as risk management for companies, maximizing their returns on investments, and improving customer service, including client retention; while Predictive Analytics specifically has become the number one defense for insurance firms against fraud.

According to the Coalition Against Insurance Fraud, fraud is one of America’s largest white-collar crimes and leads to, hold your breath, about US $80 billion in fraudulent losses each year.

With Predictive Analytics, insurance companies can better detect and “flag” potential fraudulent claims.

Table of Contents

- How Is Predictive Analytics Used In Insurance?

- Use Cases

- Predictive Analytics Procedures

- How Predictive Analytics is Beneficial

How is Predictive Analytics Used in Insurance?

Any operation in the insurance industry relies on two elements: relevant information, and accurate risk assessment. But, a large quantity of data can interrupt the flow of a working process, resulting in inaccurate results.

Hence, there arises a need of using analytics tools as they can change simple information and convert it into business intelligence as per the requirement.

In the insurance industry, Predictive Analytics is used to find out the risk level of various policies, which helps arrive at the price of insurance premiums.

Why is analytics rapidly gaining ground with insurance firms now, after all these years?

It’s not as if data analysis is something that’s brand new to this sector. What has happened of late, though, is the rapid advancements in IT and data science technology, that has brought analytics within the easy grasp of players in this sector.

Ease of use and understanding, reduction in cost barriers, and the availability of the Cloud, along with some other factors have all combined to help it along in the data-heavy world of Insurance.

Interested to know how to implement predictive analytics in your business?

Specifically, where Predictive Analytics is concerned, with easier dashboards and even DIY kits, insurance companies have finally started to understand how to operationalize the output from this form of analytics.

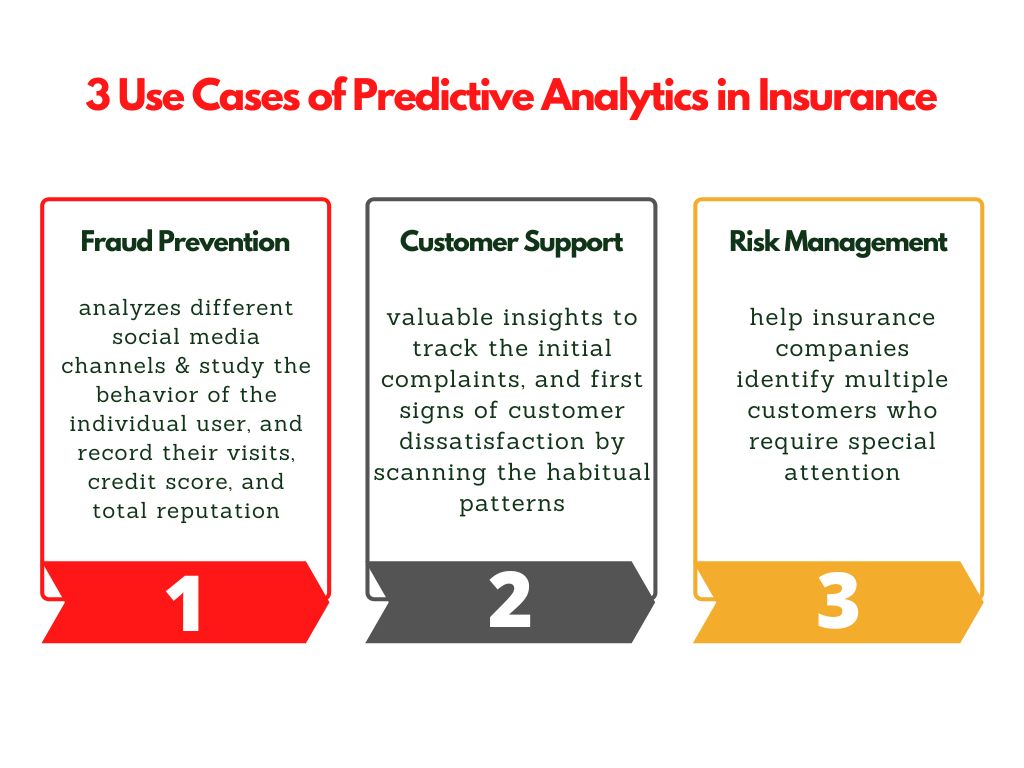

Top 3 Use Cases of Predictive Analytics In Insurance

Below-mentioned is some of the use cases of Predictive Analytics for insurance:

Fraud Prevention: Predictive analytics in the insurance industry analyzes different social media channels to monitor online activities to find out red flags.

After referring to various external sources, predictive analytics software can study the behavior of the individual user, and record their visits, credit score, and total reputation.

Customer Support: Customer support plays a key role in retaining customers.

Predictive analytics tools provide you valuable insights to track the initial complaints, and first signs of customer dissatisfaction by scanning the habitual patterns.

Apart from customer retention, and support, predictive analytics increases customer loyalty ratio by predicting their needs and personalizing the entire experience.

Risk management: This advanced analytics can help insurance companies identify multiple customers who require special attention.

It sends insurers warning signs and saves precious time that could be used to find out a potential solution.

That being said, Predictive Analytics is also used by insurance firms for other activities, one of them being marketing.

The aim is to acquire customers and then, of course, to retain them. Predictive Analytics helps target the right customers and to predict customer churn.

Another area where Predictive Analytics is deployed is underwriting. In the world of insurance, underwriters play a vital role because it’s their job to determine whether an insurance agency should undertake the risk of insuring a client or not.

They determine the risk and exposure of clients, and how much insurance should be accorded to a client, among other things.

Most of the underwriting was done by humans all these decades but now analytics propelled by ML and AI has started taking over, making the task not only so much easier since they help “predict” risk better than humans, but even far more accurate

Predictive Analytics modeling leads to better pricing of policies, eventually ending in better profitability for insurers.

Clearly, advances in AI and ML have accelerated the ability of insurers to predict risk. Algorithms can find trends and patterns that help forecast the probability of a risk situation recurring.

5 Predictive Analytics Procedures

The below-mentioned stages of Predictive Analytics are required to improve the outcomes of predictive modeling:

Identification: This step involves the identification of goals, objectives, and the expected results of the project for customizing the prediction models.

Collection of information: After gathering relevant information from various resources, automatically transfer or submit the information from different software, and store it into the preferred predictive analytics model.

Cleaning, analysis, visualization, and modeling: In this step, data must be free from unrelated bits, analyzed, and visualized. Later, data sets are made into assessing models via statistical analysis.

Testing and deployment: This step involves testing the predictive model for accuracy, and deploying it into current business processes.

Monitoring: This step defines monitoring the model’s efficiency, and accuracy in different scenarios.

How Predictive Analytics Beneficial for Life Insurance Companies?

Predictive analytics techniques are useful for life insurance companies in the following ways:

- Reduction in underwriting expenses

- The rapid increase in sales

- Significant improvement in profits

- Expense management

- Analyzing trends

Yet, this is just the start of the insurance sector’s journey with data analytics. For now, data sources are being explored in administrative systems, claims, medical records, and credit scores, to name a few departments.

But the day is not too far off when analytics will be used to transform their business model, expand customer relationships, and improve internal performance management.

An Engine That Drives Customer Intelligence

Oyster is not just a customer data platform (CDP). It is the world’s first customer insights platform (CIP). Why? At its core is your customer. Oyster is a “data unifying software.”

Liked This Article?

Gain more insights, case studies, information on our product, customer data platform