Growing Value of Finance Analytics

Since data science went mainstream, financial institutions (FI), including banks have started adopting it, or should one say, adapting to it. Read all about the growing value of analytics in finance and in the financial market.

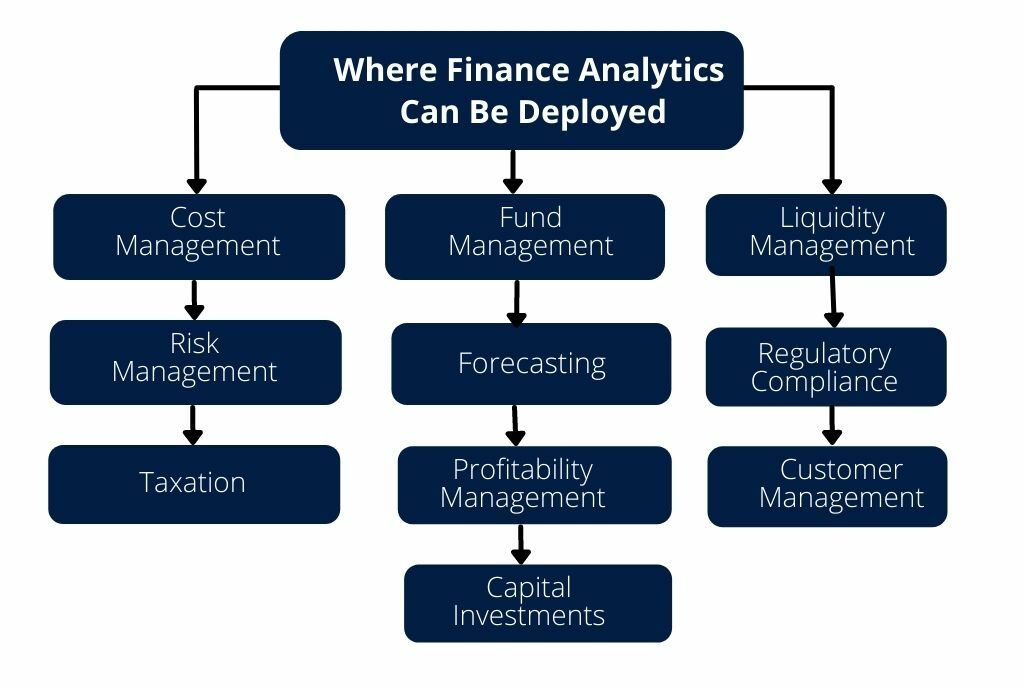

Where finance analytics can be deployed

- cost management

- risk management

- taxation

- fund management

- forecasting

- profitability management

- liquidity management

- regulatory compliance

- customer management

- capital investments

to name some. Like we have seen in other business environments, deploying analytics software is the easy part.

The need to train manpower, and gently encourage it to start incorporating the results in their daily decision-making process is the tougher one, that’s why the use of the word, “adapt” at the start of this post.

Streamline your cashflow and improve operational efficiencies using our financial analytics solution

Digitization of data and the subsequent use of analytics software platforms brought with it its own set of problems for finance professionals.

The challenge before them today, however, is the constant need to adjust to the continual changes in the field of data science with developments such as machine learning and blockchain technologies, and so on, which threaten to disrupt the sector.

Be it customer-facing business or back-end operations, Finance as a business function has gone beyond the drawing up of mere financial statements and reports.

What customers and companies today want are forward-looking, predictive insights that can help them make informed decisions and allow for course correction, preferably in real-time.

Indeed, as a recent BCG study, prepared in partnership with Morgan Stanley Research found, data analytics practices can help FIs extract value worth billions of dollars.

The study also revealed that the financial services sector trailed most industries when it came to successfully generate value and actionable insights from data analytics.

Clearly, adaptation to data science is still a problem in the world of finance.

Let us look at some of the hurdles in the way. This is in no order of priority but here they are:

- Low confidence in data

- Quick fixes without an overall business goal in mind

- Analytical systems in silos

- Poor analytical models

- Lack of analytical skills

Would You Like To Know More About Our Finance Analytics Planning Services? Get in Touch.

From a mere tool or a function in an organization, Big Data and data analytics have given Finance the larger role of a strategic support function.

The era of presenting a company’s accounts at a certain frequency sounds almost like the dinosaur age of Finance.

An organization’s financial position will be quite accurately established near instantaneously with analytics.

Take CFOs, for example. Once known in any company as the “guy who reported the numbers”, his was a largely reactive role. Now a CFO can, and has to go, beyond his traditional role.

Analytics has given him the wherewithal to get access to all of the organization’s data, not just financial, presenting him and members of the Finance team an opportunity to become more proactive, integrate into all sections of the company, and add value – a meaningful business partner, so to speak.

One area, for example, where data analytics and Finance analytics professionals can play such a role is the company budget.

Analytics has the power to take the budgeting exercise way beyond what it was all these years – a mere spreadsheet of numbers.

The Finance team now has the ability to integrate closely with other business managers to present a more sturdy document of annual projections based on predictive analytics, rather than a simple extrapolation of historic data.

Essentially, what we are saying here is that Finance professionals must now dovetail their accounting skills with management accounting tools to use data to generate predictive insights, thus influencing a company’s strategic direction.

There’s a certain degree of risk in the operations of Financial Institutions. That, and the need to take quick decisions.

Like the big-time consumer tech companies that have deployed data science, FIs, too, can now utilize analytics to take rapid calls based on the scientific interpretation of the data.

Some of the questions finance analytics can answer for FIs include:

- Are we investing in the right opportunities?

- What is our risk exposure with specific customers?

- How profitable are my products and services?

- Which customer segments offer the largest margins?

Without a doubt, financial planning and analysis are changing.

It’s not only expanding the role of a Finance professional by making him help line managers and key decision-makers optimize strategic performance, resource utilization, and profitability, but also given him powerful tools to help him make it possible to enhance his contributions to the organization – both in terms of the breadth of contribution and the level of output achievable in a given timeframe.

5 Key Benefits of Finance Analytics

Well-versed Decision Making

The Financial Analytics model produces data-driven insights and benefits businesses to make informed decisions.

Producing Sales Estimates

Financial Analytics model predict result of how accurate is your sales estimate.

Remaining Competitive

The Financial Analytics model helps your business to remain competitive.

Enhanced Cash Flow

The use of an up-to-date financial analytics prediction model helps you keep track of your currency flow.

Superior Security

Our Financial analytics model is encoded software that comes with protection mechanisms when it comes to security.

References:

https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/Analytics/ca-en-analytics-finance-analytics.pdf

https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Deloitte-Analytics/dttl-analytics-us-da-3minFinanceAnalytics.pdf

https://www.mckinsey.com/industries/financial-services/our-insights/analytics-in-banking-time-to-realize-the-value

An Engine That Drives Customer Intelligence

Oyster is not just a customer data platform (CDP). It is the world’s first customer insights platform (CIP). Why? At its core is your customer. Oyster is a “data unifying software.”

Liked This Article?

Gain more insights, case studies, information on our product, customer data platform