Using Machine Learning To Grow Customer Lifetime Value (1 of 2)

In today’s customer-centric market, it’s very important to get to know a customer’s lifetime value (CLV). Customer Lifetime Value helps businesses concentrate their activities around their most “profitable” clients. The better a business understands CLV, the better its’ strategy at retaining its best customers.

Unfortunately, many enterprises continue to ignore this crucial information.

Any debate about CLV naturally converges on the Pareto Principle: 20% of your customers represent 80% of your sales. CLV can be defined as the discounted value of future profits generated by a customer.

To put it even simpler, it’s a measurement of the revenue you will make from a customer over their buying life cycle.

Calculating Customer Lifetime Value, however, is complex.

To arrive at the lifetime value, you need to do CLV modeling. For that, you need three key inputs: Recency, Frequency, and Monetary Value, better known as RFM.

How many CLV Customer Lifetime Value models?

According to this post by Google, you can use CLV models to get answers to questions related to:

- The number of purchases a customer will make over their lifetime

- How long to wait before considering a customer gone for good

- Predicting how much revenue you’ll generate off a customer in the future

Prospect new customers with lowest churn and highest LTV

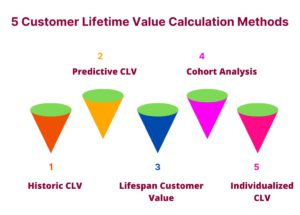

2 Modeling Methods for Customer Lifetime Value

There are two ways to look at CLV — historic CLV and predictive CLV. The historic method analyzes past data to judge how valuable a customer is. In this case, we don’t try and predict the future value of that customer’s purchases.

So the question is: what if you could classify which customers make up the 20% in the Pareto Principle, not just in the past, but in the future, too? That’s where predictive CLV modeling comes in.

With Predictive Customer Lifetime Value we can:

- Forecast the future value of existing customers with transaction history

- Predict the future value of first-time customers

Let’s focus on predictive customer lifetime value. Our goal is to model the purchasing behavior of customers to conclude what their future actions will be. But remember, not all businesses need this kind of model.

First, you should understand whether predictive CLV makes sense for your business.

If predictive CLV is right for your business, then use both. Otherwise, focus on historic CLV.

Modeling with Customer Lifetime Value

A key step in CLV Modeling is fitting a customer to a probabilistic model. This is done by taking the RFM values for all the customers, then dividing the data into segments that the model shows are likely to behave similarly.

The most common example is to group customers on a scale of 1 to 4 for each of their RFM values, and then consider all customers who fall into a certain group, such as people who are in Group 1 for all three values.

Every probabilistic model using RFM values contains a customer ID, an order date, and an order value.

Today it’s very essential to get to know a customer’s lifetime value (CLV). Want to know more about Express Analytics Predictive CLV Modeling, Speak to Our Experts to get a lowdown on how CLV Modeling can help you

We can use Artificial Intelligence to help with Customer Lifetime Value modeling.

Machine Learning (ML), a subset of AI, combines algorithms and statistics to do a specific job without any human intervention. The algorithm finds patterns in the data set. The algorithm uses these patterns to do the job better. ML is a key tool in predicting CLV.

In part 2 of this article, we’ll look at the various ML models and how they work.

An Engine that offers sophisticated CLTV modeling algorithms

Liked This Article?

Gain more insights, case studies, information on our product, customer data platform